Market Overview

Welcome to our Industrial Market Update for 2024. As we head into the new year, the short weeks are now over.

With CPI inflation at 4.7%, the OCR at 5.5%, the unemployment rate at 4% and rates uncertainty domestically and internationally we have yet to see a clear runway ahead.

Leasing Trends

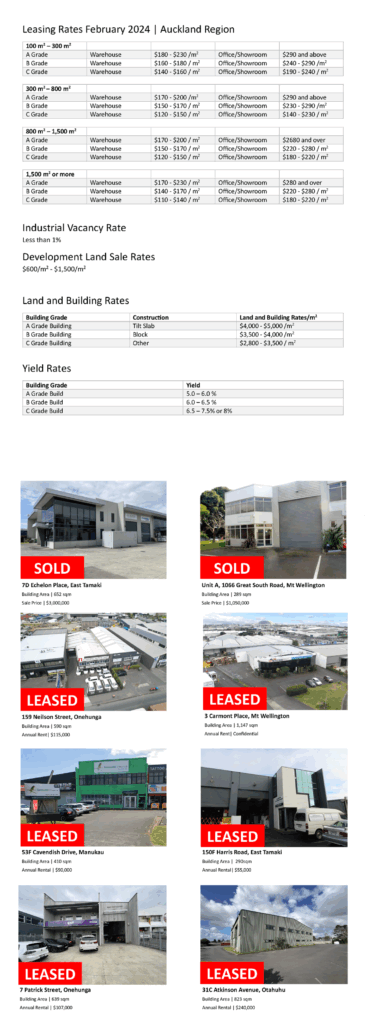

Vacancy and Rental Rates

From a leasing perspective, there is still a lack of stock with vacancy at less than 1%, however in the smaller to medium market we are seeing landlords being a bit more flexible with rental rates as the short to medium term is still uncertain. However, if you are a tenant on a lower rental rate, expect a hike in your rental.

Larger Warehouses

Larger warehouses are receiving less enquiry as established tenants are typically on lower rates than either newly vacant buildings or new buildings. If you have a larger vacant building it may be time to incentivise prospects to be more competitive. Many of our larger logistic clients are noticing their freight activity has dropped off.

Sales Opportunities

From a sales perspective, we have noticed a few more vendors looking to cash in and sell down properties. So, this will bring opportunities for buyers who are well financed.

Investment Outlook

We still see the industrial market as the best sector to invest your capital. Industrial property in NZ continues to offer strong returns despite short-term uncertainty, making it an attractive option for investors seeking stability.

If you want to discuss upcoming rent reviews and/or leasing and sales opportunities, get in touch with our industrial property experts today.